Expansion of our service offering

Most people would “take it as read” that financial services companies now use technology to make their jobs easier. The days of large handwritten ledgers are well and truly rooted in the past! Of course, Chancellor Financial Management Ltd is no different and over the past couple of years we have invested heavily in the latest “tech”, including a new back-office system that our Directors, consultants and administration teams use for transactions and record keeping on a daily basis. Many of our valued clients have registered to gain access to a user friendly version of the very same system, which is proving extremely popular.

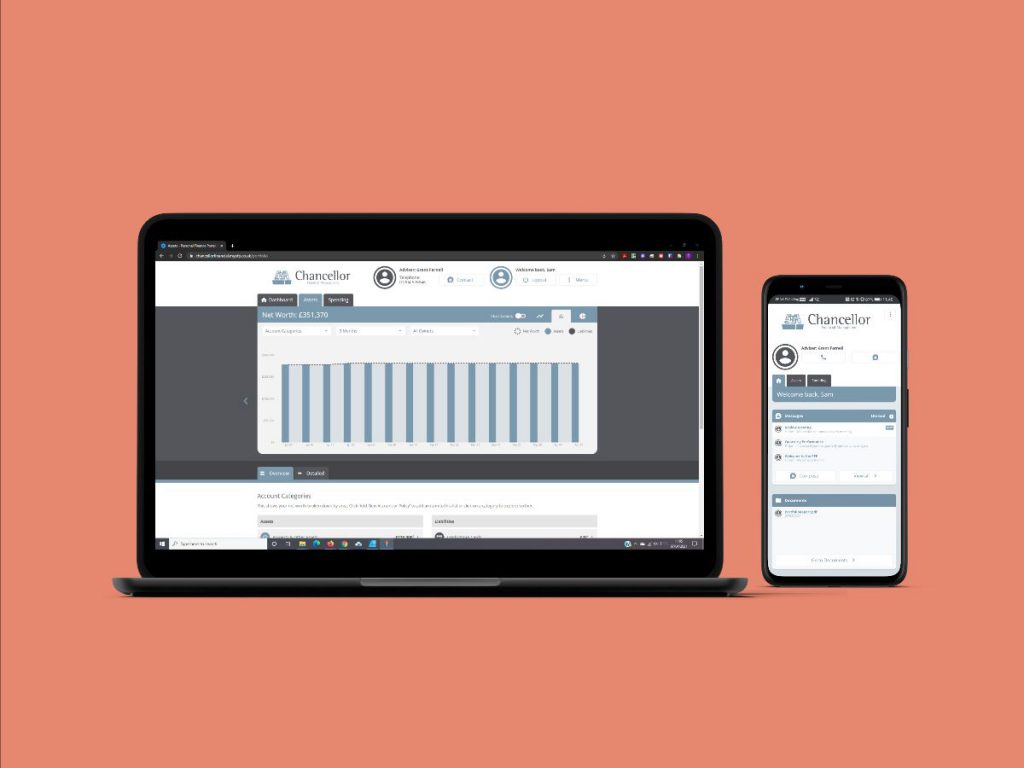

Whilst we appreciate that viewing financial records online is not for everyone for several reasons, including perceived concerns about security, lack of access to a Personal Computer, tablet or the internet, a large proportion of the people who Chancellor advise on their pensions and investment have already seen the advantages of registering for our new client “portal” which is called the Personal Finance Portal (or PFP for short!).

Anyone familiar with shopping online or internet banking, will find registering and using the system an absolute breeze. For those who may initially be less confident, we are happy to hold a one-to-one training session using online services such as Zoom or Microsoft Teams, both of which have been invaluable during the lockdown, when face to face meetings have not been possible.

Green or environmental issues are now at the forefront of many people’s minds, partly because of Sir David Attenborough’s media appearances and appeals. Using the portal can have big advantages as far as this is concerned. One of the main features of Chancellor’s services has been regular updates and valuations by post, at least every six months or in some cases even quarterly. Clients love to be provided with ongoing snapshots of their finances, but instead of having to wait for a weighty package to drop through the post, many of the arrangements that we advise on have “real time” up to date valuations available 24 hours a day 7 days a week via the new Portal. As there would be no need for paper-based valuations any longer, the amount of perceived “clutter” will be dramatically reduced, which also can have a very positive impact on the environment with less paper going to be recycled or taken to landfill sites. Saying that, if clients still require paper-based documents as well, we are more than happy to accommodate their wishes. As the data is encrypted and password protected, there is less chance of printed paperwork being seen by prying eyes – or paperwork going astray in the post.

We often see and hear reports in the media about the fact that ordinary emails are not secure, but here on our Portal any messages between clients and Chancellor are fully encrypted, thus bumping up the security aspects even further.

As well as being able to view your investments and products that are looked after here at Chancellor, the Portal can simplify your finances and paperwork even further as it is possible to upload some of your own financial documents, which can only be seen by the team here if you give permission for us to do so.

The more that our clients use the full features of the Personal Finance Portal, the better the picture of their overall finances can become. It can even integrate with your various Bank Accounts using the Government’s Open Banking Initiative which is now being used by over 3 million people in the UK to share information with their product providers, all of which must be regulated by The Financial Conduct Authority. Why can this be important? For example, when Chancellor’s advisers are dealing with the pension plans and investments of someone who has retired, the main questions are often “how much are you spending and how much do you need to live on?”. Open Banking can help our advisers when producing what we call Cash Flow Modelling, to aim to make sure the income and outgoings match up. Please rest assured that even if you incorporate this feature of the Portal, Chancellor cannot see the actual transactions on your accounts, just the broader picture and the headline account balances, that most clients provide us with as a matter of routine at the annual review meeting anyway – it just makes it simpler than trying to work it out manually!

When lockdown restrictions eventually ease and we can travel again, being able to access your finances securely on a smartphone whatever time zone you may be in, could prove to be a real boon!

If you are interested in chatting through the Portal to see if it is right for you, then please do not hesitate to contact your usual Chancellor adviser, Grant Farnell or David Torkington who will be more than happy to help.

In the meantime, if you want to do a little more research on how it works and the major features, please feel free to take a look at the User Guide https://chancellorfinancial.mypfp.co.uk/pfpuserguide#userguide2